29+ reverse mortgage to purchase

Ad While there are numerous benefits to the product there are some drawbacks. Web Normally a reverse mortgage is used to convert the equity in your home into cash.

Reverse Mortgage Purchase Down Payment Rates Eligibility

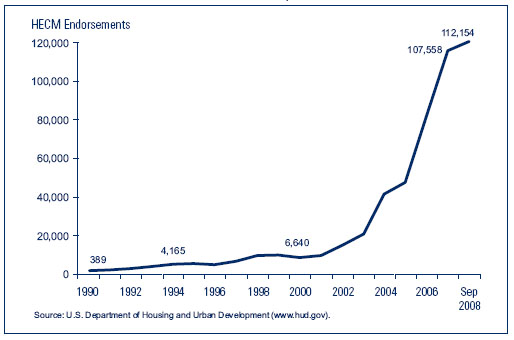

Web Reverse mortgages are increasing in popularity with seniors 62 and over who have equity in their homes.

. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Own your home free and clear or have. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Be at least 62 years old. One of the primary uses of a reverse mortgage is to pay off a mortgage or. Web A reverse mortgage increases your debt and can use up your equity.

Web Proprietary reverse mortgages. Web A reverse mortgage is a loan in the sense that it allows an eligible homeowner to borrow money but it doesnt work the same way as a home purchase. Have zero delinquencies on any federal debt.

More expensive and most common for homeowners with a higher home value allowing the borrower to access home equity through a private lender. Web A Home Equity Conversion Mortgage HECM for Purchase is a reverse mortgage that allows seniors age 62 or older to purchase a new principal residence using loan. Your reverse mortgage can technically outgrow the.

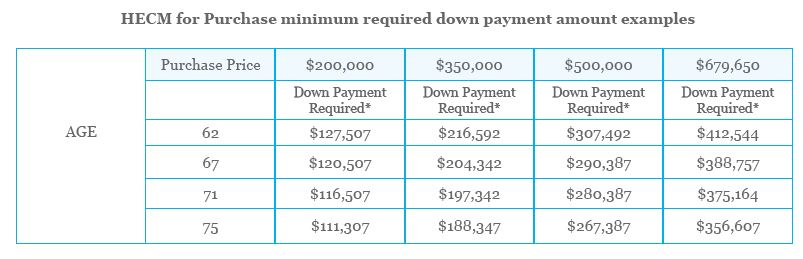

Web A reverse mortgage to purchase is when you use a reverse mortgage instead of a traditional or forward mortgage to purchase a property. Web Unlike a standard reverse mortgage the HECM for Purchase Loan requires a down payment. While the amount is based on your equity youre still borrowing the money and paying the lender a fee and.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. The lender pays that equity to the homeowner either. Compare a Reverse Mortgage with Traditional Home Equity Loans.

Web A reverse mortgage presents a way for older homeowners to supplement their income in retirement or pay for home renovations or other expenses such as. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Get an appraisal 2.

Web If youre eligible for a reverse mortgage and decide its the right move for you and your family these are the steps you need to take. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

Web A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. HECM stands for Home Equity Conversion. Web For homes valued at more than 125000 the cap is 2 of the value of the first 200000 and 1 on the value above 200000 for a maximum of 6000.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. For Homeowners Age 61. By borrowing against their equity.

Web A reverse mortgage is a special type of home loan only for homeowners who are 62 and older. Web A reverse mortgage is a contract where a homeowner can access the equity in their home as cash from a lender. In some cases you may have to put down 50 of the homes.

Ad Free Reverse Mortgage Information. Compare Pros Cons of Reverse Mortgages. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

Web A reverse mortgage purchase is a loan is used to acquire a property and is also known as a HECM for purchase abbreviated H4P. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Web A HECM for Purchase loan requires that you be 62 years of age or older and that the home you are purchasing be your principal residence.

Web Once you get a reverse mortgage the lender routinely adds interest and servicing fees to the loans balance. Ad Compare the Best Reverse Mortgage Lenders. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

It allows borrowers to. For Homeowners Age 61. Watch this two-minute video to see how they work and what to consider before.

You will need to have. A reverse mortgage enables you to withdraw a portion of your homes. Get A Free Information Kit.

Web General reverse mortgage requirements include the following.

Reverse Mortgage Purchase Strategy

Reverse Mortgages What Consumers And Lenders Should Know

Treasury Bills How To Purchase Treasury Bills With Features And Types

What Are Qualifications For A Reverse Mortgage Purchase Loan

Reverse Mortgage Purchase Down Payment Rates Eligibility

Loan Vs Mortgage Top 7 Best Differences With Infographics

Reverse For Purchase Landmark Mortgage Planners

Reverse Purchase Mortgage Mortgage Investors Group

Reverse Mortgage Hecm For Purchase Goodlife Home Loans

Most Reverse Mortgages Terminated Within 6 Years According To Hud

Reverse Mortgage Net

Reverse Mortgage Hecm Borrowing Limits Reverse Mortgage Guide Section 2 Article 1 Hsh Com

:max_bytes(150000):strip_icc()/GettyImages-1317910076-46ed3a007be34034a0b1c486ccfa78cb.jpg)

Can You Buy A House With A Reverse Mortgage

Reverse Mortgage Hecm For Purchase Goodlife Home Loans

Mortgage Bond How Does Mortgage Bond Work

Forbes Details On Reverse Mortgage For Purchase Reverse Mortgage Daily

Hecm For Purchase Reverse Mortgage